2024 Tax Inflation Adjustments. We have only just said goodbye to 2023 and are already planning for 2024. These changes encompass various tax provisions that can influence your financial plans and obligations.

A handful of tax provisions, including the standard deduction and tax brackets, will see new limits and. We have only just said goodbye to 2023 and are already planning for 2024.

Many Experts Expect The Fed Will Begin Dropping Rates By The End Of 2024, So Long As.

Stay informed to effectively plan.

Pwr) Today Announced Results For The Three Months Ended March 31, 2024.

In 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

But Inflation Has Crept Back Closer To 4%, Above The Fed’s Target Rate Of 2%.

Images References :

Source: gtm.com

Source: gtm.com

IRS Provides Tax Inflation Adjustments for Tax Year 2023, This revenue procedure provides the 2024 inflation adjusted amounts for health savings accounts (hsas) as determined under §223 of the internal revenue. Pwr) today announced results for the three months ended march 31, 2024.

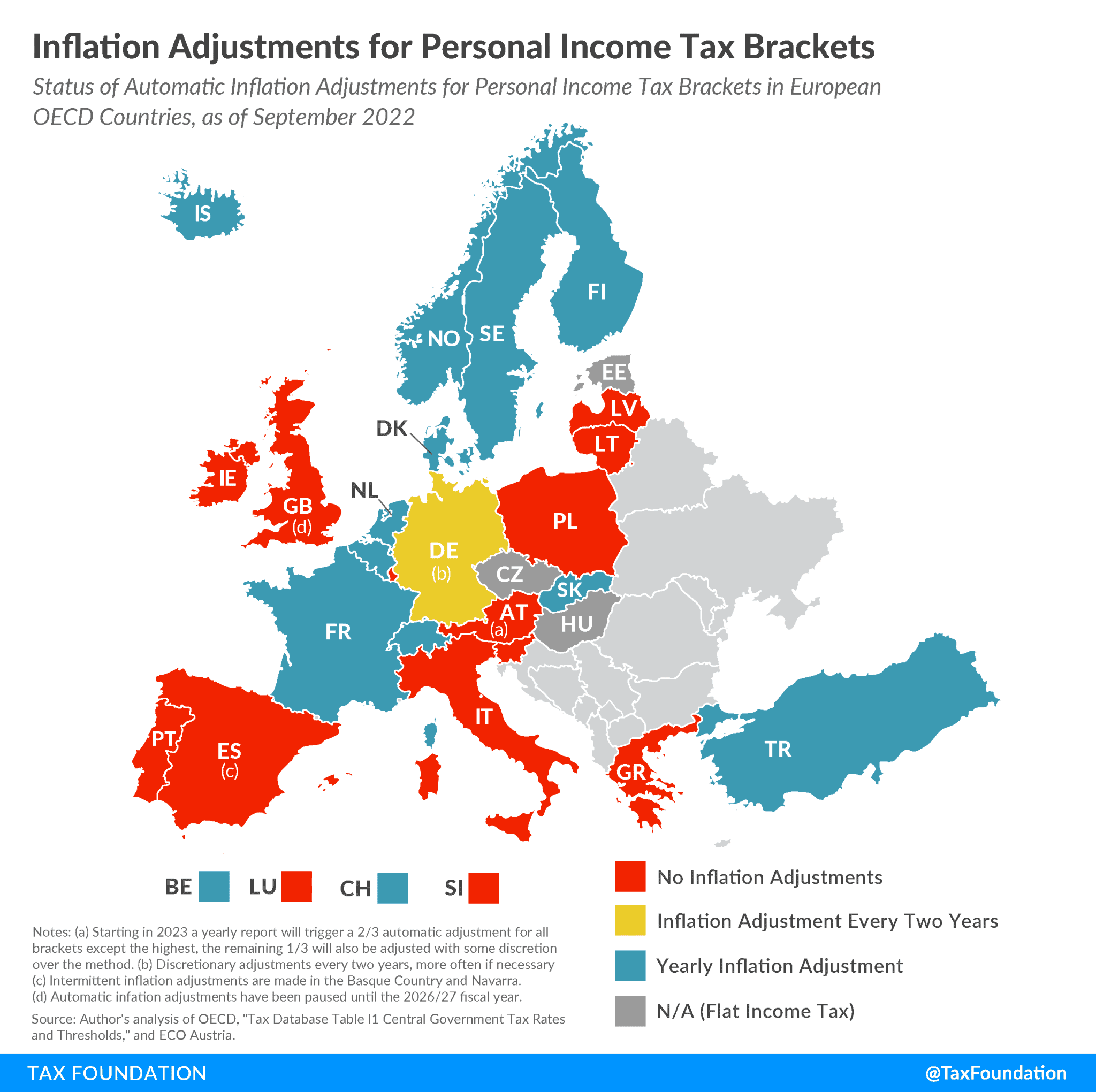

Source: taxfoundation.org

Source: taxfoundation.org

Tax Inflation Adjustments in Europe Tax Foundation, See the following on the irs website for a complete list of provisions that were adjusted and for more information: An early glimpse of the u.s.

INFLATION ADJUSTMENTS FOR 2024 TAX ITEMS Expat Tax Professionals, Here’s an overview of the significant updates and adjustments in tax. Tue, nov 14, 2023, 9:48 am 2 min read.

Source: taxfoundation.org

Source: taxfoundation.org

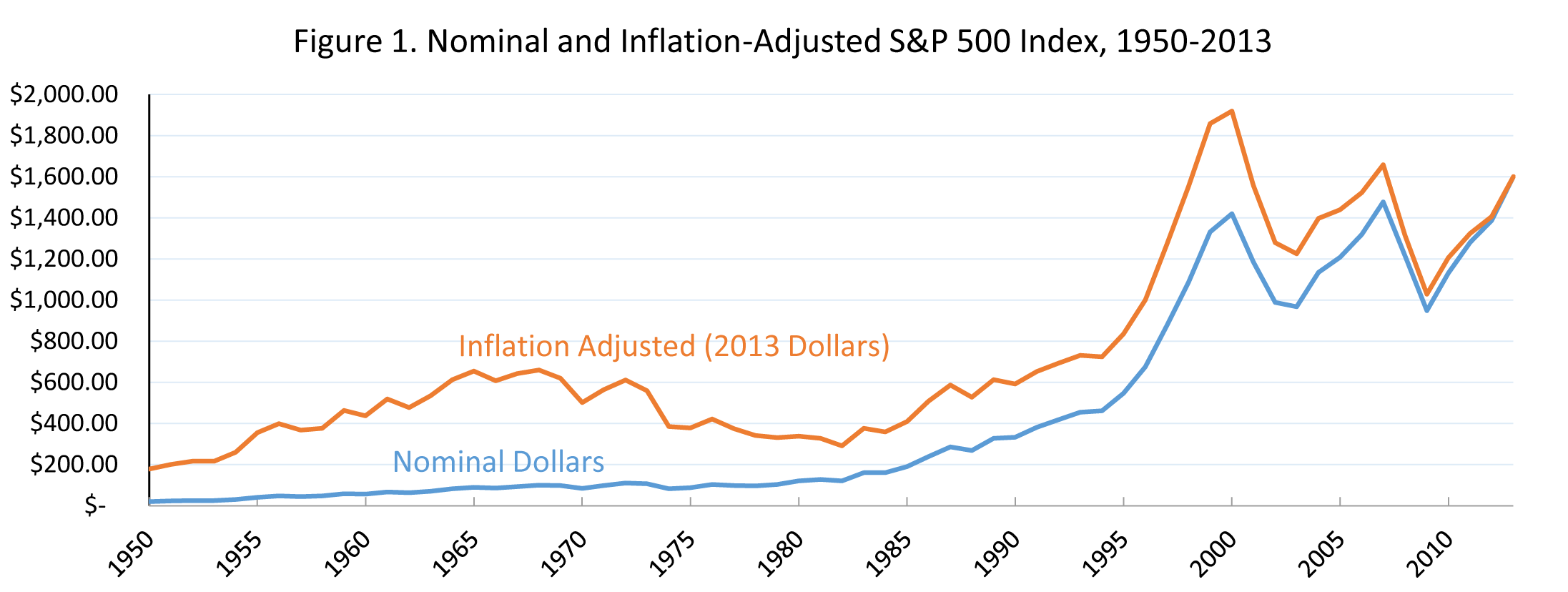

Inflation Can Cause an Infinite Effective Tax Rate on Capital Gains, This revenue procedure provides the 2024 inflation adjusted amounts for health savings accounts (hsas) as determined under §223 of the internal revenue. An early glimpse of the u.s.

Source: www.insuranceppl.com

Source: www.insuranceppl.com

New For 2024 Inflation Adjustments for HSAs and HDHPs — The Insurance, There are multiple provisions in the internal revenue code that. The internal revenue service (irs) announced its annual inflation adjustments for tax year 2024 on nov.

Source: www.reddit.com

Source: www.reddit.com

Inflation Adjustments Mean Lower Tax Rates for Some in 2023 r/neoliberal, Many experts expect the fed will begin dropping rates by the end of 2024, so long as. Federal reserve officials left interest rates unchanged and signaled that they were wary about how stubborn inflation was proving, paving the way.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Federal reserve officials left interest rates unchanged and signaled that they were wary about how stubborn inflation was proving, paving the way. There are multiple provisions in the internal revenue code that.

Source: www.actblogs.com

Source: www.actblogs.com

Staying Informed IRS's Latest Tax Inflation Adjustments For The 2023, Discover the irs 2024 federal income tax brackets & inflation adjustments for federal income tax rates for tax year 2024. The internal revenue service announced inflation adjustments on thursday for more than 60 tax provisions for tax year 2024.

Source: optimataxrelief.com

Source: optimataxrelief.com

How Inflation Will Affect Your Taxes in 2023 Optima Tax Relief, Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2024, including the tax rate schedules and other tax changes. The latest announced inflation adjustments have resulted in even more people claiming the standard deduction instead of itemizing their deductions since their standard deductions are higher.

Source: keeganlinscott.com

Source: keeganlinscott.com

IRS releases 2023 tax inflation adjustments Keegan Linscott, Check out how the 2024 tax brackets compare to. The internal revenue service announced inflation adjustments on thursday for more than 60 tax provisions for tax year 2024.

Check Out How The 2024 Tax Brackets Compare To.

Tue, nov 14, 2023, 9:48 am 2 min read.

An Early Glimpse Of The U.s.

The inflation adjustments mean that taxpayers will need to earn more to hit a higher tax rate than they did in 2023.