Bas Due Dates 2024 Australia. The due date for lodging and paying is displayed on your business activity statement (bas). The us army, navy and air forces all use it too.

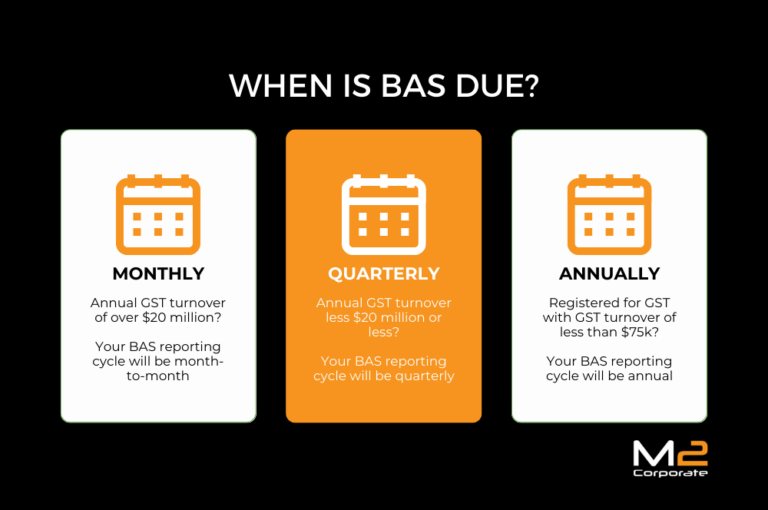

In australia, the due dates for lodging and paying your bas depend on your business’s reporting frequency and turnover. Complete and return by the due date on your.

The Due Date For Lodging And Paying Is Displayed On Your Business Activity Statement (Bas).

Calculate gst, payg, and other obligations:

How To Lodge Your Bas?

If you did not have a spouse for the full year, print x in the.

If You Are On A Monthly Cycle Your.

Images References :

Source: www.officeworks.com.au

Source: www.officeworks.com.au

Make BAS Preparation Easier with These TimeSaving Tips Work, Complete and return by the due date on your. Date due for the quarter is october 28.

Source: darellqzaneta.pages.dev

Source: darellqzaneta.pages.dev

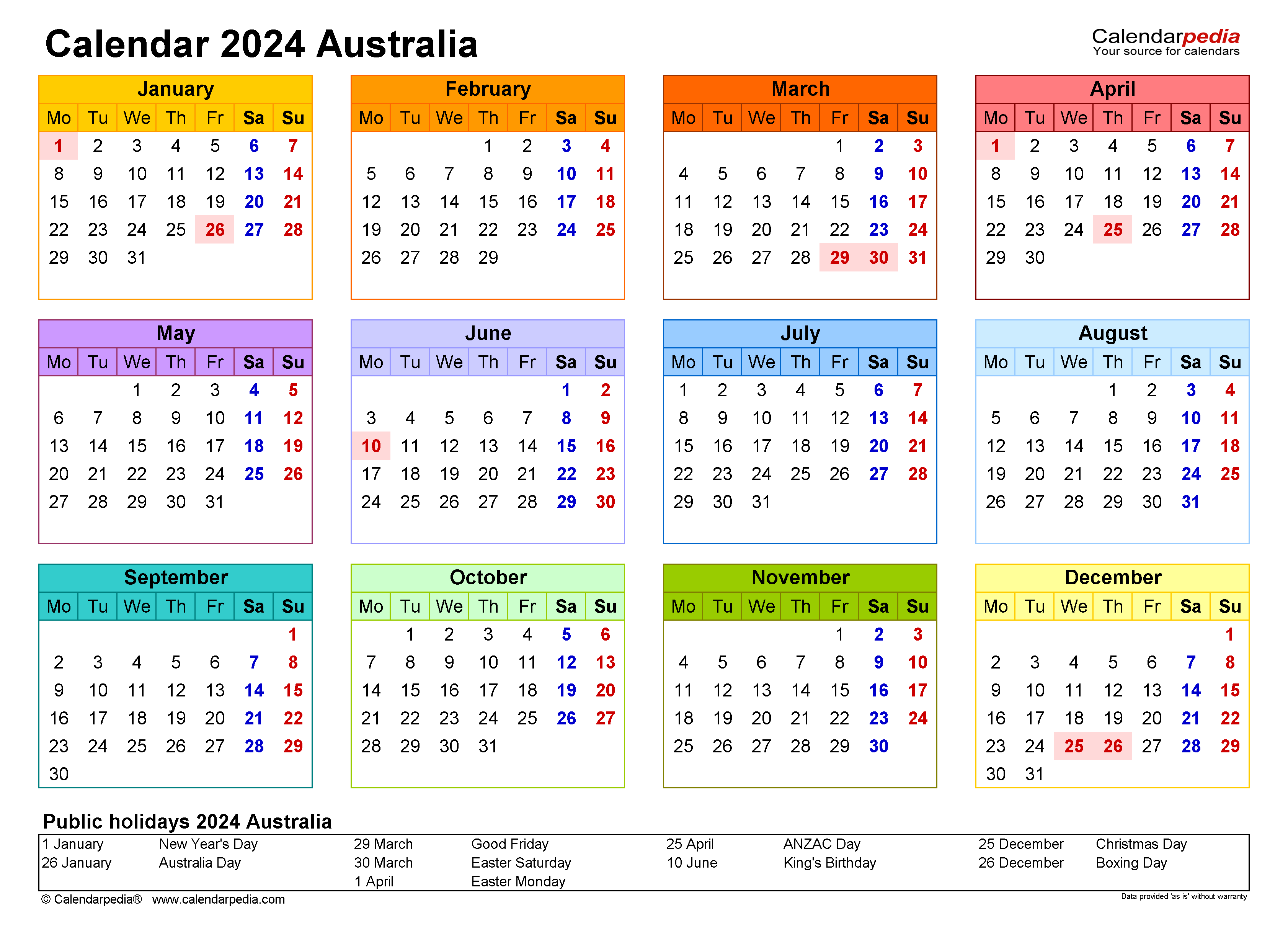

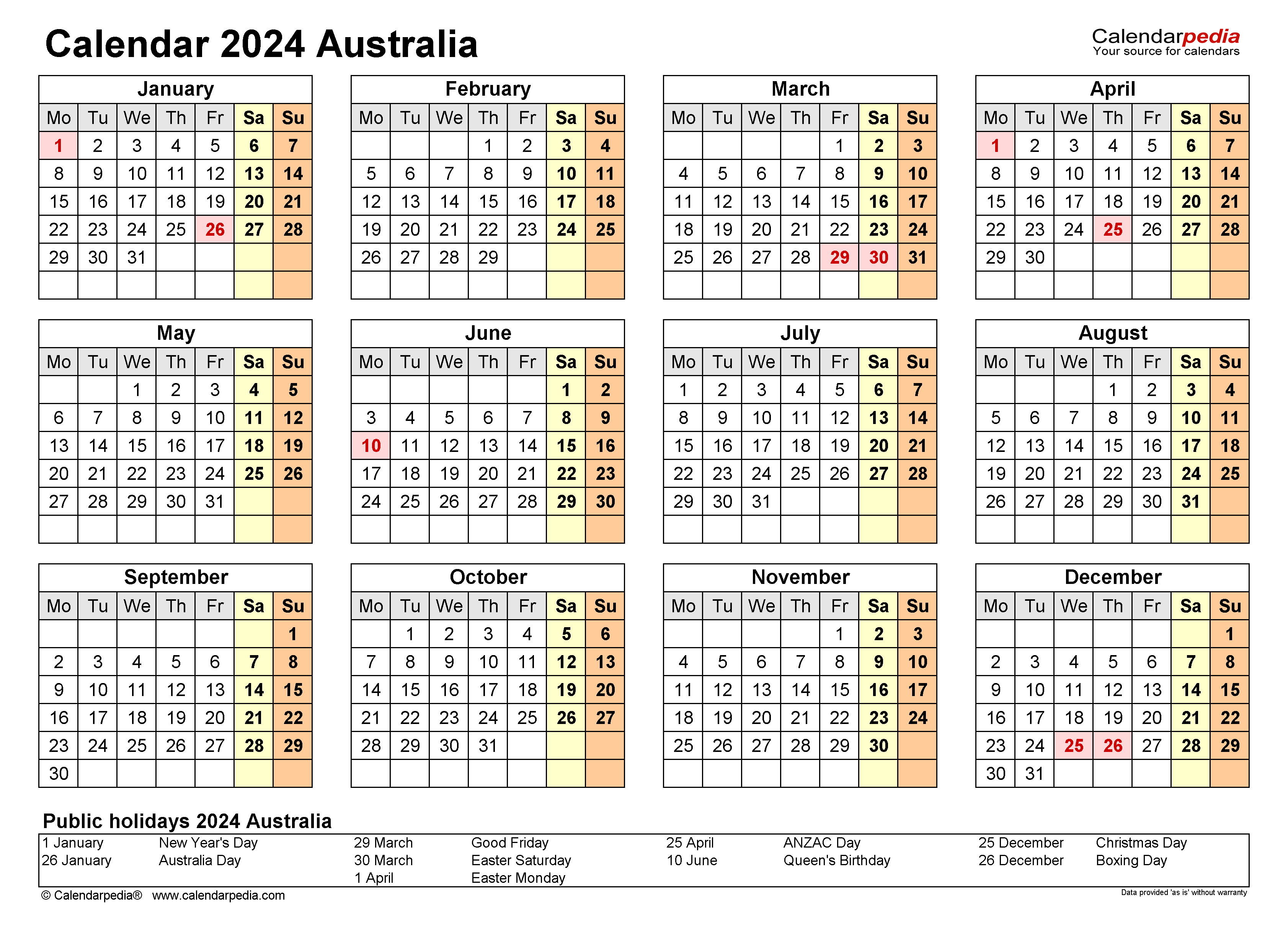

Calendar 2024 Printable Australia Renee Charline, Final date for lodgment and payment (if required) if you do not have an income tax return lodgment. Quarter 2 (1 october 2023 to 31 december 2023):

![What is BAS Due Dates [2023 2024] and How to Lodge it My Tax Daily](https://mytaxdaily.com.au/wp-content/uploads/2023/10/bas-due-dates-1024x683.webp) Source: mytaxdaily.com.au

Source: mytaxdaily.com.au

What is BAS Due Dates [2023 2024] and How to Lodge it My Tax Daily, Quarter 1 july to september bas is due 28 november (or 21 october if you are not using an accountant or tax agent) quarter 2 october to december. Keep your business on track with these key bas due dates for 2024:

Source: tupuy.com

Source: tupuy.com

2024 Calendar 2024 Printable Australia Printable Online, Here are the general due dates: What are the key bas due dates for 2024?

Source: www.calendarpedia.com

Source: www.calendarpedia.com

Australia Calendar 2024 Free Printable PDF templates, When the due date for lodgment. Keep your business on track with these key bas due dates for 2024:

Source: www.m2corporate.com.au

Source: www.m2corporate.com.au

When Is BAS Due in 20232024? Everything You Need to Know, Quarter 3 (1 january 2024 to 31 march 2024): If you are on a monthly cycle your.

Source: www.m2corporate.com.au

Source: www.m2corporate.com.au

When Is BAS Due in 20232024? Everything You Need to Know, Quarter 1 july to september bas is due 28 november (or 21 october if you are not using an accountant or tax agent) quarter 2 october to december. Due date 28 february 2024.

Source: www.onlineservices.net.au

Source: www.onlineservices.net.au

Reminder BAS quarter lodgement dates, The due date for lodging and paying is displayed on your business activity statement (bas). 28th day after each quarter, with an exception for q2 (28 february 2024).

Source: tammarawailey.pages.dev

Source: tammarawailey.pages.dev

Business Taxes Due 2024 Tiff Anabelle, Annual gst return or annual gst information report: The due date for lodging and paying is displayed on your business activity statement (bas).

Source: jaha.com.au

Source: jaha.com.au

Due Dates for BAS Jaha Online Accountant, As some dates may vary, please ensure you contact the australian taxation office to double check any dates in question. Check out the due dates for lodging and paying your bas.

Quarter 2 (1 October 2023 To 31 December 2023):

Date due for the quarter is october 28.

The Federal Government Will Spend An Extra $5.7 Billion On Defence Over The Next Four Years, And A Projected $50.3 Billion More In The Decade To Come As It Continues.

Due date 28 february 2024.