Estate Taxes Federal 2024. The federal government has an estate tax only, but states can have one, both, or none, which can make death taxes even more confusing. If the estate generates more.

If the estate generates more. The federal government has an estate tax only, but states can have one, both, or none, which can make death taxes even more confusing.

Each State Sets Its Own Exemption.

However, if they outlive the tax law sunset, their exemptions will drop to $7 million each.

The Exemption From Gift And Estate Taxes Is Now Just Above $13.6 Million, Up From About $12.9 Million Last Year.

Visit the estate and gift taxes page for more comprehensive estate and gift tax information.

As 2024 Unfolds And With The April 15Th Tax Filing Date Looming, It’s A Good Time To Pay Attention To The Federal Estate And Gift Tax Exemption.

Images References :

Source: www.urban.org

Source: www.urban.org

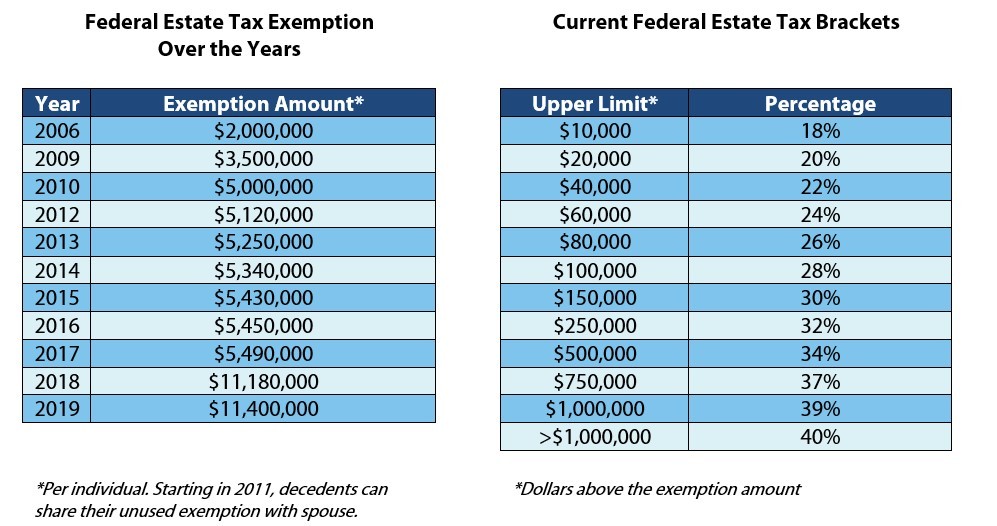

Estate and Inheritance Taxes Urban Institute, The federal estate tax exemption amount went up again for 2024. This allows spouses to transfer a significant amount of wealth without incurring federal estate or gift taxes.

Source: www.smartdraw.com

Source: www.smartdraw.com

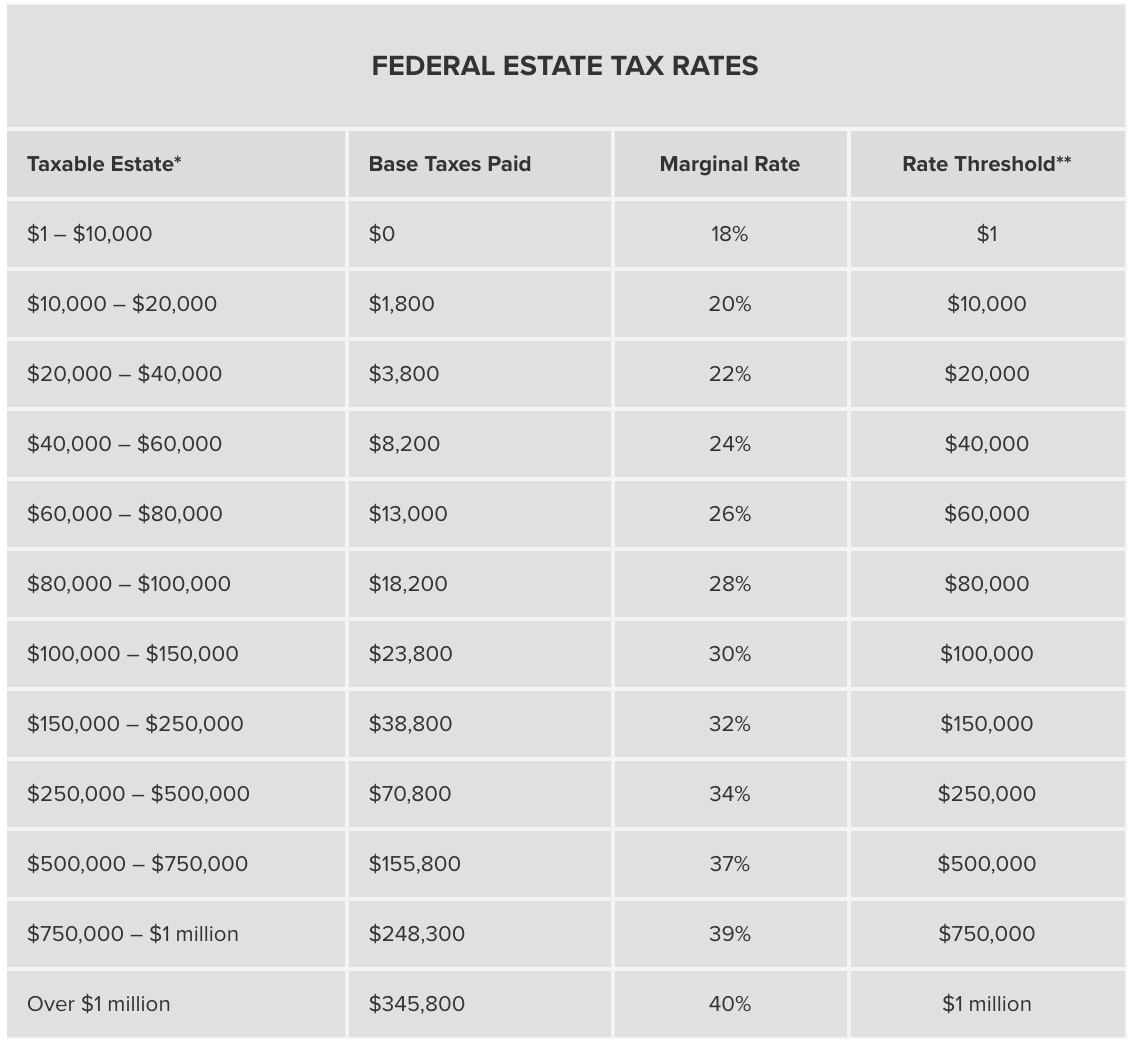

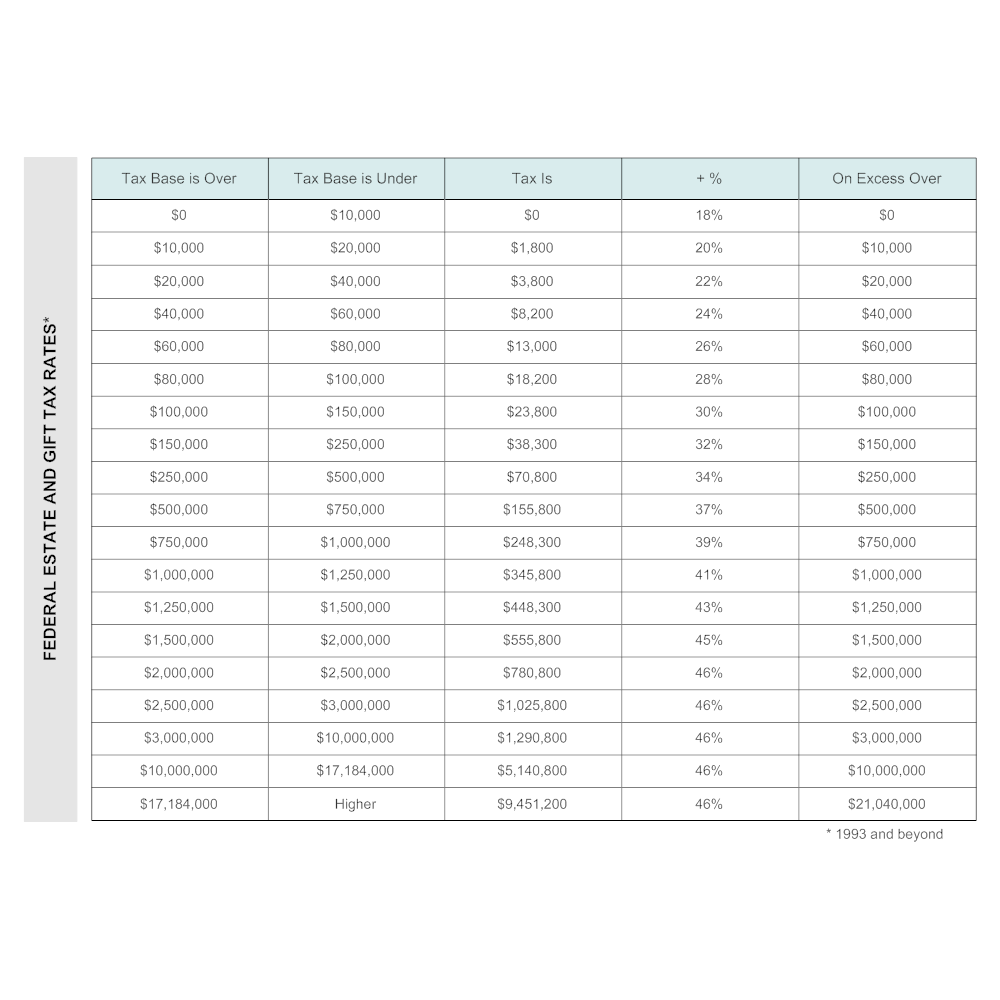

Federal Estate Tax Chart, Visit the estate and gift taxes page for more comprehensive estate and gift tax information. The exemption from gift and estate taxes is now just above $13.6 million, up from about $12.9 million last year.

Source: cwoconner.com

Source: cwoconner.com

Estate Planning Technique Grantor Retained Annuity Trusts C.W. O, Serves as a reliable resource covering topics focused on federal estate and gift tax planning, return preparation, tax payment, and more. The faqs on this page provide details on how tax reform affects estate and gift tax.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Currently, due to laws set a few. A comprehensive guide shawn smith • dec 21, 2023 understanding taxes can be daunting, especially when it comes to.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Currently, due to laws set a few. If the estate generates more.

Source: asenaadvisors.com

Source: asenaadvisors.com

What is the U.S. Estate Tax Rate? Asena Advisors, In addition to the lifetime. An estate tax is a tax imposed on the total value of a person's estate at the time of their death.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, The types of taxes a deceased taxpayer's estate can owe are: An estate tax is a tax imposed on the total value of a person's estate at the time of their death.

Source: www.cbpp.org

Source: www.cbpp.org

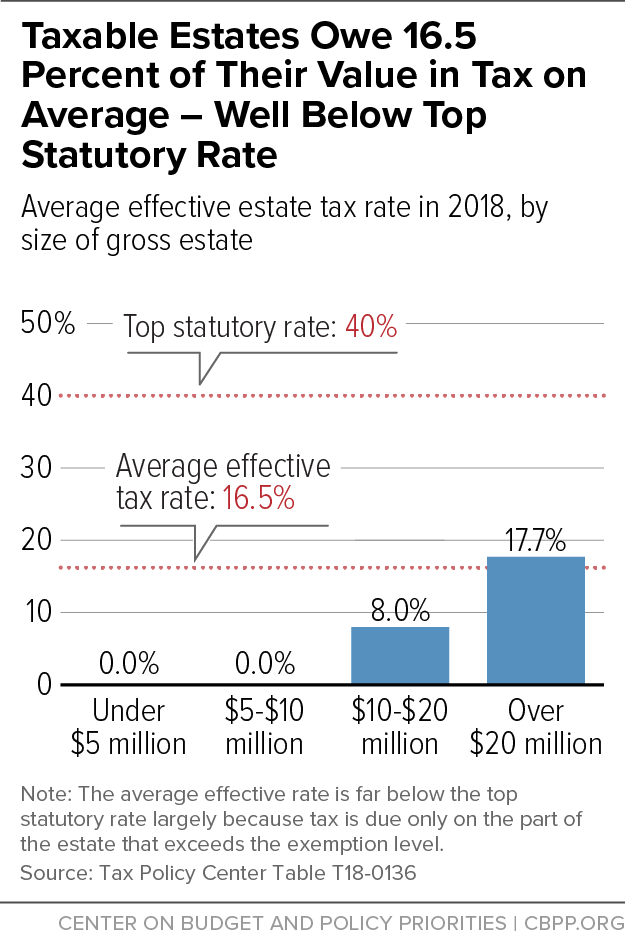

Policy Basics The Federal Estate Tax Center on Budget and Policy, Visit the estate and gift taxes page for more comprehensive estate and gift tax information. A higher exemption means more estates may be exempt from the federal tax this year, which can.

Source: www.cbpp.org

Source: www.cbpp.org

Ten Facts You Should Know About the Federal Estate Tax Center on, In 2024, the federal gst tax exemption increased along with the federal gift and estate tax exemption to us$13,610,000 per taxpayer (us$27,220,000 for a married. However, if they outlive the tax law sunset, their exemptions will drop to $7 million each.

Source: www.smartdraw.com

Source: www.smartdraw.com

Federal Estate and Gift Tax Rates, A higher exemption means more estates may be exempt from the federal tax this year, which can. The estate tax is often a topic of concern for those inheriting assets.

As 2024 Unfolds And With The April 15Th Tax Filing Date Looming, It’s A Good Time To Pay Attention To The Federal Estate And Gift Tax Exemption.

In 2024, the federal gst tax exemption increased along with the federal gift and estate tax exemption to us$13,610,000 per taxpayer (us$27,220,000 for a married.

The Exemption From Gift And Estate Taxes Is Now Just Above $13.6 Million, Up From About $12.9 Million Last Year.

Each state sets its own exemption.